Introduction: The Market Loves Traps

False swing points are where many traders lose money. A move looks like the start of a new trend — but instead, it stalls, reverses, and takes traders out.

The solution is combining multiple forms of analysis:

- Volume (to confirm conviction).

- Candlestick confirmation (to prove buyer/seller strength).

- Volatility analysis (ATR) to measure range strength.

- Tools like RevCan, which filter noise and highlight genuine swing confirmations.

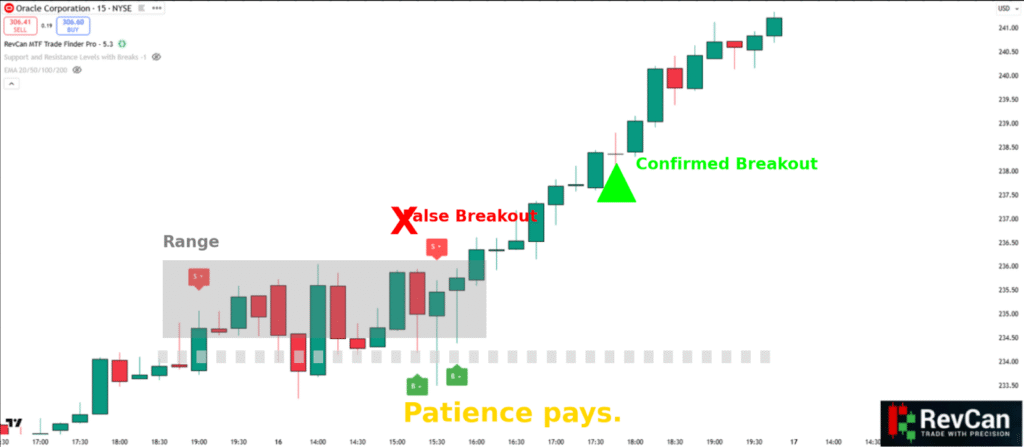

Spotting Consolidation Traps

Markets often “rest” in sideways ranges. New traders jump in too early, only to get chopped up. Professionals wait for breakouts with confirmation.

Volume spikes, candlestick breakouts, and RevCan alerts help filter real moves from false starts.

False Breakouts and Volume Confirmation

A breakout without volume is often a trap. A breakout with strong volume is conviction. Traders can confirm this using volume analysis — RevCan integrates similar logic by filtering out weak setups.

Avoiding Swing Traps in Practice

- Wait for volume confirmation.

- Use ATR to measure breakout strength.

- Avoid trading inside ranges.

- Rely on tools that filter invalid signals (RevCan, moving averages, confluence).

Conclusion

False swings can destroy confidence. But by combining analytics — volume, ATR, candlestick confirmation — with filtering tools like RevCan, traders can avoid the traps and focus on high-quality moves.

👉 Stay disciplined, avoid false swings, and trade smarter with RevCan at revcan.io.