Introduction: The Art of Swing Trading

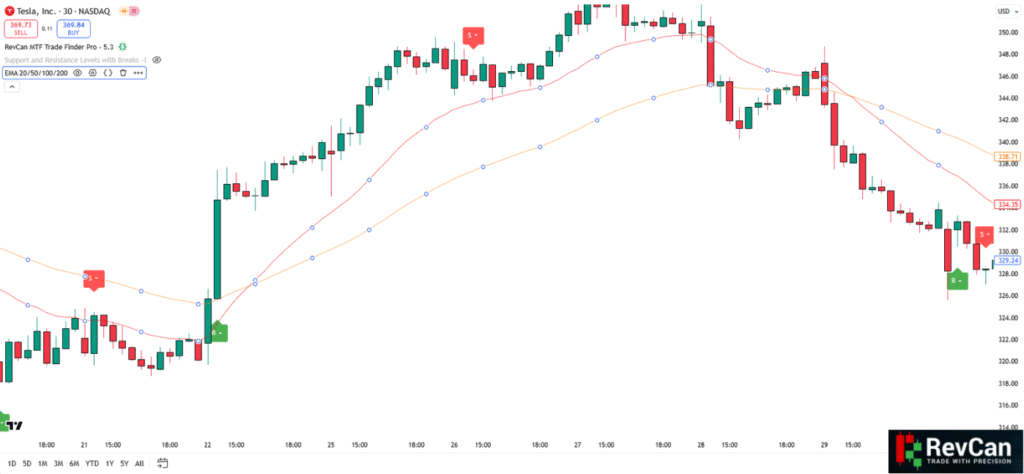

Timing is everything in trading. Enter too early, and the market whipsaws you out. Enter too late, and the best part of the move is already gone. Swing trading aims to capture those “sweet spots” — meaningful portions of a trend that can deliver solid returns without the stress of hyperactive scalping.

But swing trading is not about luck. It’s about identifying repeatable price behaviors and confirming them with analytics-driven signals. Traders who learn to blend price action, candlestick psychology, moving averages, and volume analysis are better equipped to find high-probability entries. Tools like RevCan enhance this by filtering the noise and pointing to valid swing zones — helping you act with clarity when probabilities are stacked in your favor.

The Three Golden Steps of Swing Trading

Every swing trader, whether beginner or seasoned, relies on three core steps:

- Identify the trend: Higher highs/lows = uptrend. Lower highs/lows = downtrend.

- Locate valid swing points: Higher lows (uptrend) and lower highs (downtrend) are where reversals often form.

- Wait for confirmation: Candlestick patterns (engulfing, pin bar, inside bar) act as triggers, ideally supported by volume.

Overlaying moving averages (like 30 EMA & 50 EMA) can add confidence — they often act as dynamic support or resistance zones. Meanwhile, momentum indicators like RSI can show whether a swing is likely to sustain.

RevCan doesn’t replace these analytics; it complements them. By combining price action with algorithmic filters, it highlights valid swing setups while ignoring weak or noisy signals.

Confirmation: Patience Pays Off

Impatience is the downfall of many traders. To confirm an uptrend, wait for two consecutive higher highs and higher lows. For a downtrend, wait for two lower highs and lower lows.

This is where combining analytics adds depth:

- Candlesticks show trader psychology.

- Volume validates conviction.

- Moving averages highlight trend support/resistance.

- RevCan integrates these principles, signaling only when the structure is valid.

Patience isn’t passive; it’s active analysis.

Managing Risk Like a Professional

Swing trading isn’t just about entries. Risk management defines long-term survival. Professionals know to:

- Place stops just beyond the swing low/high.

- Use at least a 1:2 risk-to-reward ratio.

- Size positions so only 1–2% of capital is at risk per trade.

Analytics like ATR (Average True Range) can help set logical stop levels based on volatility. RevCan adds another layer by guiding traders toward natural swing-based zones for stops and targets.

Avoiding Swing Trading Mistakes

The most common mistakes include:

- Fighting the trend — shorting uptrends, buying downtrends.

- Chasing early swings — entering before structure is confirmed.

- Overtrading — ignoring quality filters.

The antidote is analytics. Use moving averages, volume, Fibonacci retracements, and RevCan to validate structure before acting.

Conclusion

Swing trading mastery requires structure, patience, and analytics. Price action gives the roadmap, candlesticks show psychology, indicators add confidence, and RevCan sharpens the signal.

The sweet spot isn’t about predicting the future — it’s about stacking probabilities.

👉 Ready to bring more structure into your trading? Start integrating advanced analytics with RevCan today at revcan.io.